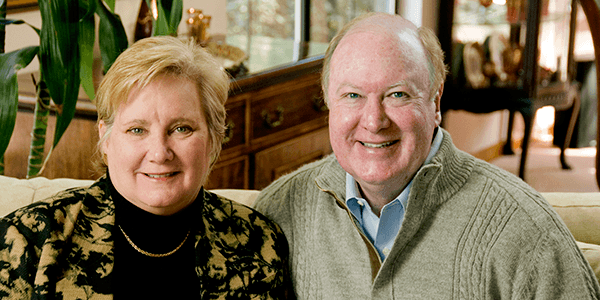

Karen and David bought a vacant lot on the Shore many years ago. They had planned to build a second home so that their family could spend their summers there. As time went on, David's job kept him in town and the children grew up before Karen and David had the financial resources to build on the land.

David: Over the years, the lot increased in value. We paid about $40,000 for the property, and it is now worth almost $500,000.

Karen: With the children out of the house, we were thinking of selling the property. We wanted to avoid paying so much in capital gains tax on the sale.

After speaking to their tax advisor, Karen and David discovered that if they gave a 25% interest in the property to the Allentown Symphony Association, they would receive two benefits. First, they would receive an income tax deduction for the value of the gift. Second, they would avoid capital gains tax on the portion of the property that they gave to charity.

Karen: That is what we decided to do. By giving the Allentown Symphony Association a 25% interest in the property prior to the sale, we saved the capital gains tax on that part. The deduction offset a large portion of the tax on the $375,000 we received when the property actually sold. We are pleased with the "double benefit" from giving the property, and the Allentown Symphony received $125,000.

A part gift and part sale of an appreciated asset is an excellent tax strategy. You can use the deduction from the gift portion to offset the capital gains from the sale portion of the transaction.

If you would like to learn more about part gift and part sale strategies, please give us a call. We are happy to answer your questions.